|

||||

|

In this Update:

Helping Pennsylvanians at the Pump

After automatically rising last year due to inflation, the 2024 Pennsylvania gas tax will return to 2022 levels. Last year, the average wholesale price of gasoline exceeded $2.99 per gallon, which triggered an automatic increase in the gas tax. Knowing how Pennsylvanians were already struggling with skyrocketing inflation, the Senate passed and sent to the House of Representatives my legislation last January to end these inflation-based, automatic gas tax hikes. Had the House acted in a timely fashion, Pennsylvanians would have saved more than $200 million in the gas tax. We continue to encourage our counterparts to work cooperatively with us to benefit commonwealth residents as we were elected to do. Giving Students the Tools to Succeed

The passage of the 2023-24 state budget reflects important Senate Republican priorities, including helping students by dedicating an additional $567 million to Basic Education and an additional $150 million for education tax credits to provide scholarships to students so they can learn in an education environment that best suits their needs. We also ensured greater collaboration in keeping children safe in the classroom by consolidating school safety programs and operations under the Pennsylvania Commission on Crime and Delinquency. The commission already manages the highly successful School Safety and Security Grant Program created by the Senate in 2018. As mental health needs continue to rise, we allocated $100 million for K-12 mental health programs for schools so children have the basic foundation to succeed educationally. Reducing the Tax Burden

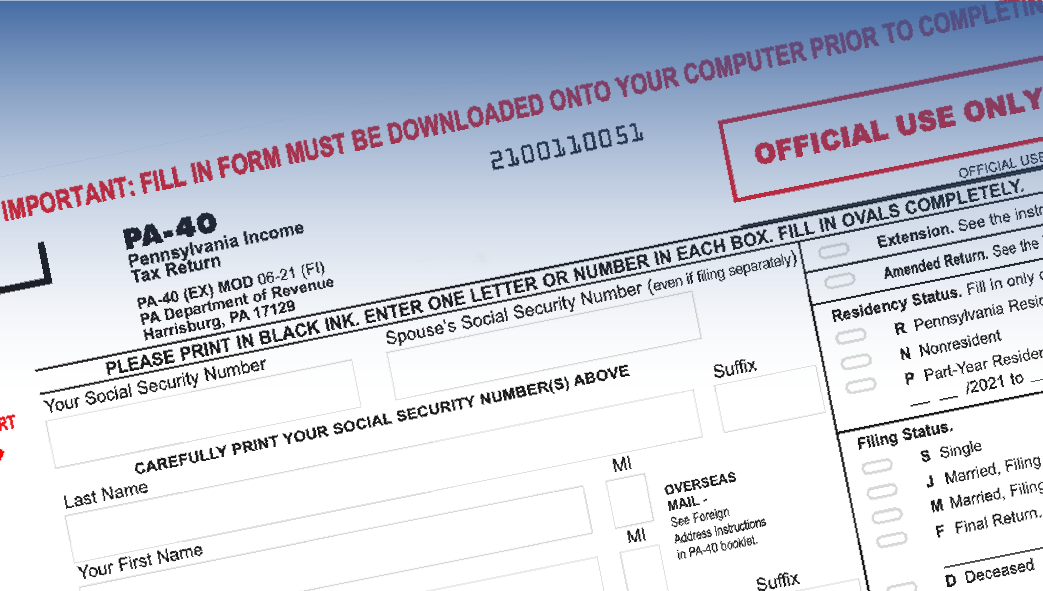

As part of the state budget, Senate Republicans voted to reduce the tax burden. One initiative would address a barrier to employment for working families by giving parents additional support to continue to seek and maintain employment. The legislation also exempts Dependent Care Assistance and Flexible Savings Accounts, which are used to cover health care expenses, from the state Personal Income Tax. They were already exempt from federal taxes. Finally, it helps counties and municipalities avoid raising taxes on their residents. It increases the payment made for state-owned property dedicated to outdoor recreation to $2.40 per acre to be paid from the State Gaming Fund. Previously, open spaces for the public’s enjoyment were more of a financial burden because they aren’t owned by businesses or individuals. Recognizing Law Enforcement in Our Communities

Tuesday, Jan. 9, is Law Enforcement Appreciation Day. Protecting our communities is a dangerous and demanding job, but men and women across the state answered the call to public service. They leave their families not knowing if they’ll need to give their lives to keep us safe. I appreciate their selflessness and commitment to others and was proud to vote for legislation to help them. Act 60 of 2023 expands the list of law enforcement entities covered under the Heart and Lung Act, which provides for salary and medical expenses to be paid when an officer or firefighter is injured on the job. Other new laws passed by the Senate allow municipal police to conduct fingerprint-based criminal history checks on police applicants and funds an additional 100 Pennsylvania State Police troopers to help make our communities safer. |

||||

|

||||

Want to change how you receive these emails? 2025 © Senate of Pennsylvania | https://www.senatorlangerholc.com | Privacy Policy |